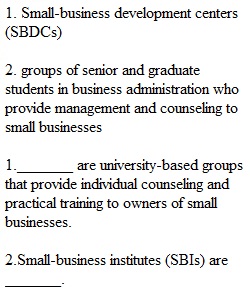

Q The Small Business Administration: Resources for Entrepreneurs The Small Business Administration (SBA) is a government agency that assists, counsels, and protects the interests of small businesses in the United States. The SBA offers both financial and management counseling. SBA Management Assistance The SBA’s Management Assistance Program offers free individual counseling, conferences, workshops, and publications. They also offer courses on specific areas of business as well as a survey course that covers many areas of business management. Additionally, the SBA has several groups that provide help to small-business owners: • Service Corps of Retired Executives (SCORE) is a group of more than 10,000 retired and active businesspeople, including veterans, women, and people of color, who volunteer their services to small-business owners through the SBA. • Small-business institutes (SBIs) are groups of senior and graduate students in business administration who provide management and counseling to small businesses. The groups of students are led by faculty advisers and SBA management-assistance experts. • Small-business development centers (SBDCs) are university-based groups that provide individual counseling and practical training to owners of small businesses. These groups can provide managerial and technical help as well as other types of specialized assistance. SBA Financial Assistance Small businesses need money to start the business but also many times throughout the life of the business for expansion or even for help after natural disasters. The SBA offers several financial-assistance programs, but its primary financial function is to guarantee loans to eligible businesses. These loans are given by traditional private lenders like banks, but the SBA guarantees repayment. Help for Small Businesses Owned by Underrepresented Groups The SBA also provides financial help for women and people of color who may have trouble acquiring loans from banking institutions. Women and people of color are eligible for all of the SBA’s programs, but the SBA makes a special effort to help members of underrepresented groups. A few of their programs and efforts include: • The Minority Business Development Agency awards grants to develop and increase business opportunities for people of color. • Local offices devoted to supporting women, Native American, veteran, and LGBTQ-owned businesses. • SCORE has dedicated resources and mentors for Latino- and Black-owned small-business owners. • SBA Women’s Business Centers offer training and technical assistance and access to credit and capital for women looking to start a business. 1._______ are university-based groups that provide individual counseling and practical training to owners of small businesses. 2.Small-business institutes (SBIs) are _______. 3.________ is a group of more than 10,000 retired and active businesspeople, including veterans, women, and people of color, who volunteer their services to small-business owners through the SBA.

View Related Questions